How to Check if the Loan Company is Legitimate

Finding a legitimate loan company is not an easy task. Before undertaking a loan, it’s essential to gather all the details about the legitimacy of the company. The last thing in the world you want to deal with is shady and suspect financial woes as a result of a less than stellar loan company.

Table of Contents

- Legitimate vs. Illegitimate

- Check the Address of the Loan Company

- Does the Loan Company Require Advance Payment?

- Take the Loan Agreement to a Lawyer for Review

- Conduct a Search of the Better Business Bureau Database

- Contact Your State’s Financial Registration Agency or Banking Oversight Agency

- Dial the Phone Number of the Loan Company

- Visit the Ripoff Report and Consumer Affairs Websites

- Look For a Company Email

- Direct Lenders vs Matching Services

- Direct Lenders

- Matching Services

Legitimate vs. Illegitimate

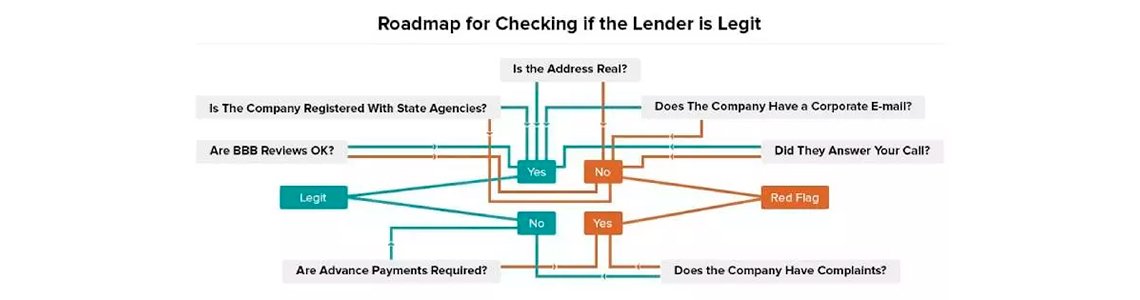

It is beneficial to know that there are many short-term loan companies that can help you get back on your feet again. But there is a downside to this: there are far more illegitimate loan companies than legitimate ones. When conducting your research, there are many details you can look for to prove whether a loan company is what they say they are.

On the other hand, the Internet makes it easy to confirm a business’s legitimacy. In this sense we’ve outlined some key points that will help you find the information you need.

Check the Address of the Loan Company

If the address has a “P.O. Box” address instead of a street address that’s a big red flag. Also be wary if you can’t find the address online, then that is another strike against the legitimacy of the loan company.

Does the Loan Company Require Advance Payment?

If the answer is yes then this company is not legitimate. Reputable loan companies disclose all fees up-front and deduct them from the loan amount you receive, instead of demanding money up-front. Don’t be fooled by promises that an advance payment will secure your loan.

Take the Loan Agreement to a Lawyer for Review

If you aren’t sure about a loan contract, an attorney will be able to determine if it is clear and legal. Avoid a company that rushes you. High-pressure tactics to hurry you into signing a contract are red flags suggesting you are dealing with a loan scammer. Legitimate lenders will not object to a review by your legal counsel. In fact, they and may even suggest that you do so.

Conduct a Search of the Better Business Bureau Database

Go to your local BBB website and select “Check out a business or charity.” You can then search by the loan company’s name, type of business along with other identifying information such as the website URL, email, physical address or phone number.

Contact Your State’s Financial Registration Agency or Banking Oversight Agency

Loan companies are required by law to register with state agencies to do business within a state. If a company is not legitimate, these government agencies will provide you with the information accordingly.

Dial the Phone Number of the Loan Company

It’s a bad sign if you can’t seem to reach any actual person and are cycled through a touch tone phone system. Be wary. Any reputable company will have customer-service representatives available to answer your questions. If the company doesn’t list a phone number at all then you definitely know this company is a scam.

Visit the Ripoff Report and Consumer Affairs Websites

Do a thorough search on the loan company you’re considering doing business with. Websites like RipoffReport.com and ConsumerAffairs.com contain a database of complaints lodged against companies that have turned out to be fraudulent. By entering the name of the company in question, you will turn up any results that can give you an idea of its legitimacy, or lack thereof.

Look For a Company Email

It’s a big red flag if your correspondence is from a generic email address like a Gmail, Hotmail or outlook account, not to mention an email address that looks like it’s from a legitimate institution but is spelled incorrectly. You are most likely dealing with a scam loan company then.

Direct Lenders vs Matching Services

As a customer, It’s critical to understand the difference between direct lenders and matching services. A direct lender is in charge of the entire lending process. They screen your loan application, decide if you qualify, answer your questions, then transfer the money to your account. A matching service acts as a broker between yourself as a borrower and multiple lenders that provide loans. A loan matching service doesn’t make loan decisions, nor can they be held liable for the decisions direct lenders make or the services they provide. Take into account these differences when estimating if a company is legit.

When borrowing from a direct lender, you are in contact with one company. If you apply for a payday loan via a matching service, your application goes to several companies from the broker’s network. That means that more businesses see your request, and you get an answer from the one that approves you. Even when you trust the matching service, go the extra mile and scan a few reviews of the business contacting you. That will be your direct lender, so you need to know they’re legit.

Direct Lenders:

1. Oasis Financial offers legal funding to victims of auto or workplace accidents before their cases are closed. Oasis Financial helps people with injuries meet their financial needs and access the health solutions they require.

- Address: 9525 Bryn Mawr Ave Ste 900 Rosemont, IL 60018-5264

- Website: https://www.oasisfinancial.com

- BBB-accredited: yes, rated A+

- Trustpilot review: 4.4 (Excellent)

- Valid phone number: (877) 333-6680

- Valid email: yes, not disclosed on their website

- Ripoff Report: some registered complaints

2. Credit9 provides loans and debt consolidation solutions for their customers. The company prides itself on offering quick assistance to the people who need it most. They have been on the market since 2013.

- Address: 18201 Von Karman Ave Ste 700 Irvine, CA 92612-1058

- Website: https://credit9.com/

- BBB-accredited: yes, rated A+

- Trustpilot review: 4.4 (Excellent)

- Valid phone number: (800) 291-0172

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

3. Mobilend specializes in debt consolidation solutions and mobile lending. The team has been offering its services since 2016. Mobilend cooperates with national banks and credit issuers to help their customers save more and obtain lower interest.

- Address 400 Spectrum Center Dr Ste 350, Irvine, CA 92618-5017

- Website: https://www.mobilend.com/

- BBB-accredited: yes, rated A+

- Other reviews: none

- Valid phone number: (866) 330-1669

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

4. On Deck Capital offers loans to small businesses in the US. Their use of data analytics and digital technology allows them to assess the creditworthiness of a business in a timely manner.

- Address: 1400 Broadway 25th Floor, New York, NY 10018-5225

- Website: https://www.ondeck.com/

- BBB-accredited: yes, rated A+

- Trustpilot review: 4.9 (Excellent)

- Valid phone number: (888) 269-4246

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

5. ACE Cash Express provides financial services and products like payday loans, prepaid cards, installment loans, etc. The business operates both in-store and online and takes pride in the speedy process they have developed.

- Address: 300 E John Carpenter Fwy, Suite 900, Irving, TX 75062

- Website: none active

- BBB-accredited: no

- Trustpilot review: 4.5 (Excellent)

- Valid phone number: (972) 550-5000

- Valid email: yes, not disclosed on their website

- Ripoff Report: some registered complaints

6. CashNetUSA is an online lender with over 3 million customers and over ten years of experience. Their products include payday loans, installment loans, and line of credit.

- Address: 175 W Jackson Blvd Ste 1000, Chicago, IL 60604-2863

- Website: https://www.cashnetusa.com/

- BBB-accredited: no

- Trustpilot review: 4.6 (Excellent)

- Valid phone number: (888) 801-9075

- Valid email: yes, not disclosed on their website

- Ripoff Report: some registered complaints

7. Advance America is a major provider of financial services. Their offices span in over 1,400 locations in the entire country. Their products include payday loans, installment loans, title loans, personal lines of credit.

- Address: 5604 75th Street, Kenosha, WI 53142

- Website: https://www.advanceamerica.net/

- BBB-accredited: no

- Trustpilot review: 4.8 (Excellent)

- Valid phone number: (262) 697-6298

- Valid email: yes, not disclosed on their website

- Ripoff Report: some registered complaints

8. Birchman Lending used to specialize in providing payday loans. Their website is currently down.

- Address: 450 Broadway Ste 1456, San Diego, CA 92101

- Website: none active

- BBB-accredited: no

- Other reviews: none

- Valid phone number: (888) 276-2674

- Valid email: none

- Ripoff Report: no registered complaints

9. Brighten Loans is a place for consumers looking for mortgage loans. The company offers support purchasing the first home, debt consolidation, or loans for home improvement with bad credit.

- Address: 135 E Huntington Dr, Arcadia, California 91006, US

- Website: http://brightenlending.com/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: (888) 227-4808

- Valid email: [email protected]

- Ripoff Report: no registered complaints

10. Moneylion is a mobile banking and financial membership platform that provides online financial services. The company takes pride in offering quality customer assistance.

- Address: P.O. Box 1547, Sandy, UT 84091-1547

- Website: https://www.moneylion.com/

- BBB-accredited: no

- Trustpilot review: 4.6 (Excellent)

- Valid phone number: (888) 704-6970

- Valid email: [email protected]

- Ripoff Report: some registered complaints

Matching Services:

1. Simple Path Financial is a loan-referral service that has been in business for over four years. The company advertises offering from $7,500 in personal loans and offering personalized customer service.

- Address: 16842 Von Karman Ave Ste 200, Irvine, CA 92606-4989

- Website: https://www.simplepathfinancial.com/

- BBB-accredited: yes, rated A+

- Other reviews: none

- Valid phone number: 877-804-4145

- Valid email: not displayed on their website

- Ripoff Report: no registered complaints

2. TriPoint Lending provides loan brokerage services for customers in financial distress. Their mission is to help others improve their financial situation by finding the right personal loan for them.

- Address: 4 Park Plz Ste 1400, Irvine, CA 92614-8560

- Website: https://tripointlending.com/

- BBB-accredited: yes, rated A+

- Other reviews: none

- Valid phone number: (800) 307-1789

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

3. Firelend connects borrowers who need short-term loans with a network of loan providers. Customers can borrow up to $2,500 through their website.

- Address: none

- Website: https://firelend.com/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: none

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

4. Groove Loan is a service that introduces borrowers and lenders. Customers can get up to $5,000 via their website.

- Address: none

- Website: https://grooveloan.com/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: none

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

5. Plush Funding is a loan referral service that has been on the market since 2008. The company has helped thousands of clients obtain unsecured loans.

- Address: none

- Website: https://plushfunding.com/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: (800) 221-1216

- Valid email: [email protected]

- Ripoff Report: no registered complaints

6. Mega Loans / Loan Factory is a mortgage broker that searches for the best loan rates among 39 lenders.

- Address: 2195 Tully Rd, San Jose, CA 95122-1346

- Website: https://www.megaloans.com / www.loanfactory.com

- BBB-accredited: yes, rated A+

- Trustpilot review: 4.0 (Great)

- Valid phone number: (408) 877-8000

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

7. MidWeek Pay connects potential borrowers with lenders offering loans from $100 to $5,000.

- Address: none

- Website: https://midweekpay.com/

- BBB-accredited: no

- Trustpilot review: 4.7 (Excellent)

- Valid phone number: none

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

8. Fiona provides the tools for customers to search for the financial services they need: personal loans, savings, credit cards, life insurance, mortgages. Even Financial created the company.

- Address: 50 West 23rd Street, Suite 700, New York, NY 10010

- Website: https://fiona.com

- BBB-accredited: no

- Other reviews: 4.3 (Excellent)

- Valid phone number: (800) 614-7505

- Valid email: [email protected]

- Ripoff Report: no registered complaints

9. RiverLend is a place to find a short-term loan of up to $2,500. The company works with a national network of lenders.

- Address: none

- Website: https://riverlend.com/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: none

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

10. Clear Loan Solutions helps borrowers find personal or payday loans within their network of lenders.

- Address: none

- Website: http://www.clearloansolution.net/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: (855) 462-5019

- Valid email: [email protected]

- Ripoff Report: no registered complaints

11. 5K Funds provides a marketplace for customers to find loans from $500 to $35,000. The company works with a network of authorized lenders.

- Address: none

- Website: https://www.5kfunds.com/

- BBB-accredited: no

- Trustpilot review: 3.8 (Great)

- Valid phone number: none

- Valid email: yes, not disclosed on their website

- Ripoff Report: no registered complaints

12. Lendflare connects borrowers and lenders. Customers can apply for up to $10,000.

- Address: none

- Website: https://lendflare.net/

- BBB-accredited: no

- Other reviews: none

- Valid phone number: none

- Valid email: [email protected]

- Ripoff Report: no registered complaints

13. 24/7 Lending Group allows clients to borrow between $1,000 and $35,000 from their network of lenders. The company has established its reputation for over 15 years of activity.

- Address: 14460 Falls of Neuse Rd #314, Raleigh, NC 27614-8227

- Website: https://www.247lendinggroup.com/index.htm

- BBB-accredited: no

- Trustpilot review: 4.7 (Excellent)

- Valid phone number: (888) 316-2918

- Valid email: yes, not disclosed on their website

- Ripoff Report: some registered complaints

Be aware, that if a loan offer seems too good to be true, it most likely is not good at all. Scammers prey on people desperate for financing by offering loans without credit check or income verification. While this may look like an ideal solution when you are struggling the company may not be who they represent themselves as.

If you accept this offer hastily without determining its legitimacy, you can end up in a worse position than before. To spot a fraudulent loan offer do your research and make sure to know what to look for to verify the validity of the loan offer.

Our company woorks only with legitimate lenders and loan companies who operate in accordance with OLA an Best Lending Practices. So, if you need emergency money, or you have bad credit and need a loan, please fill out the online payday loans application and cover your financial needs with no hassles and troubles.

Sources and References

1. Bankrate “7 ways to spot personal loan scams” https://www.bankrate.com/loans/personal-loans/personal-loan-scam-signs/

2. The Nest “How to Tell If a Loan Offer Is Legit?” https://budgeting.thenest.com/ask-lower-interest-rate-3675.html

3. Finder.Com “How to avoid a personal loan scam” https://www.finder.com/personal-loan-scams

4. WikiHow “How to Check if a Company Is Genuine” https://www.wikihow.com/Check-if-a-Company-Is-Genuine

Get Payday Loans Online!Take your first step today and get preapproved for a LoanApply Online NowI read and agree to Terms, Rates, Privacy Policy before submitting a loan request.